Arbitrum’s DeFi Renaissance Incentive Program (DRIP) enters Epoch 5 with heightened focus on stablecoin lending Arbitrum, where Aave and Morpho dominate the reward pools for looping strategies. As ARB holds steady at $0.2199, reflecting a modest 24-hour gain of and 0.0305%, savvy traders are positioning to earn ARB rewards DRIP offers amid $3.21 billion in DeFi TVL. Morpho’s syrupUSDC/USDC market commands 420K ARB plus 90K additional incentives for USDC lending, while Aave remains paused yet reserved for potential reactivation, per the latest Arbitrum Governance Forum update. This epoch prioritizes performance-based borrowing, amplifying yields through leverage on protocols like Morpho and Aave.

DRIP’s structure rewards time-weighted average borrow balances across two-week epochs, with Season One allocating 24 million ARB from a 80 million total. The discovery phase has identified Morpho as a frontrunner, funneling liquidity into high-efficiency stablecoin loops. Yet risks loom large: leveraged positions invite liquidation, and ARB rewards at $0.2199 per token won’t offset total losses, as governance warnings emphasize. For Arbitrum DeFi yields 2025, the key lies in disciplined looping on eligible assets like USDC and syrupUSDC.

Morpho Emerges as Epoch 5 Powerhouse for Stablecoin Loops

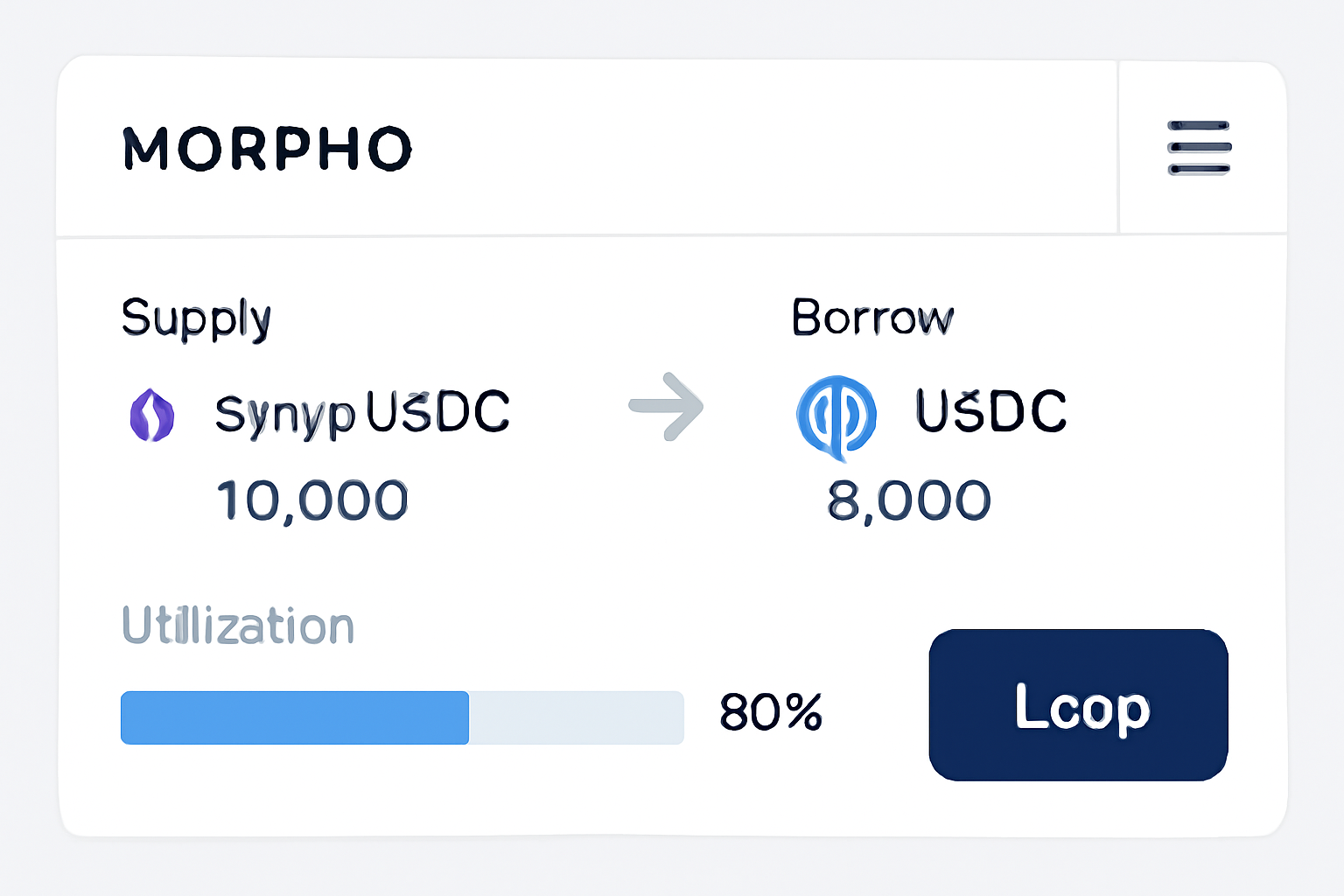

Morpho’s allocation underscores its edge in Aave Morpho looping Arbitrum setups. The 420K ARB pool targets the syrupUSDC/USDC market, incentivizing USDC borrows against yield-bearing collateral. This setup thrives on looping, where users supply syrupUSDC, borrow USDC at up to 75% LTV, and redeposit to multiply exposure. Recent Morpho forum proposals, like MIP 114, layer on 135,000 MORPHO tokens worth $250,000, supercharging returns. With Arbitrum’s TVL at $19.1 billion network-wide, these incentives aim to deepen liquidity and counter L2 rivals like Base.

Aave’s pause introduces caution, but its V3 USDC markets hold reserved DRIP slots. Post-reactivation, recursive loops could unlock reserved rewards, blending stability with leverage. Hybrid approaches across protocols optimize further, pushing combined APYs past 15% when factoring ARB multipliers at current $0.2199 pricing.

Arbitrum (ARB) Price Prediction 2026-2031

Forecasts incorporating DRIP Epoch 5-8 incentives, stablecoin TVL growth via looping strategies on Morpho/Aave, and 24M ARB rewards amid DeFi expansion

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY % Change (Avg from 2025 $0.22) |

|---|---|---|---|---|

| 2026 | $0.18 | $0.55 | $1.20 | +150% |

| 2027 | $0.35 | $1.10 | $2.50 | +100% |

| 2028 | $0.70 | $2.20 | $5.00 | +100% |

| 2029 | $1.20 | $3.50 | $8.00 | +59% |

| 2030 | $1.80 | $5.00 | $12.00 | +43% |

| 2031 | $2.50 | $7.50 | $18.00 | +50% |

Price Prediction Summary

ARB’s price is forecasted to recover and grow significantly from its 2025 level of ~$0.22, propelled by the DRIP program’s 24M ARB incentives across Epochs 5-8, which encourage stablecoin looping on Morpho and other protocols to boost TVL and activity. Bearish mins reflect dilution and market downturns; bullish maxes assume L2 dominance and bull cycles. Average trajectory projects ~34x growth by 2031 to $7.50, with realistic ranges based on historical cycles, TVL scaling to $50B+, and Ethereum synergies.

Key Factors Affecting Arbitrum Price

- DRIP incentives driving stablecoin borrow volumes and TVL growth via looping on Morpho (420K ARB Epoch 5), Fluid, etc.

- Arbitrum’s strong L2 positioning ($19.1B TVL) vs. competitors like Base/OP

- Crypto market cycles: post-2025 bull run potential with BTC/ETH halving effects

- Token utility increase from rewards offsetting emission dilution (~80M ARB program)

- Regulatory clarity for DeFi lending and L2s enabling mainstream adoption

- Technological upgrades: Arbitrum Orbit, Ethereum scaling improving throughput/costs

- Macro risks: bear markets, competition from Solana L2s, liquidation events in loops

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Five Prioritized Looping Strategies to Capture Epoch 5 Rewards

To maximize stablecoin yields, focus on these five battle-tested loops, calibrated for Morpho and Aave amid Epoch 5 dynamics. Each leverages DRIP’s borrow-heavy mechanics while navigating utilization caps and health factors.

- Morpho syrupUSDC/USDC 3x Looping Strategy: Supply syrupUSDC as collateral on Morpho, borrow USDC up to 75% LTV, redeposit USDC to amplify borrow volume and capture 420K ARB incentives. This 3x setup excels in performance phases, targeting the 90K USDC lending bonus.

- Aave V3 USDC Recursive Loop: Deposit USDC on Aave (post-pause activation), borrow stablecoins iteratively to 2.5x leverage targeting reserved DRIP rewards while monitoring health factor. Ideal for conservative yield farmers awaiting Aave’s green light.

- Hybrid Morpho-Aave Loop: Supply USDC on Morpho for syrupUSDC borrow, transfer to Aave for further USDC leverage, optimizing combined APYs above 15% with ARB multipliers. Cross-protocol efficiency shines here, blending Morpho’s depth with Aave’s reserves.

Executing the Morpho syrupUSDC/USDC 3x Loop for Peak Efficiency

Dive into the Morpho syrupUSDC/USDC 3x Looping Strategy, Epoch 5’s crown jewel. Start by supplying syrupUSDC, a yield-bearing stablecoin, into Morpho’s optimized vault. At 75% LTV, borrow USDC equivalent to three times your initial collateral value through iterative redeposits. This amplifies your time-weighted borrow balance, directly scaling ARB claims from the 420K pool. Current math: with ARB at $0.2199, a $10,000 position could net hundreds in weekly rewards, plus base lending APY north of 10% from syrupUSDC’s native yields. Monitor utilization; Morpho’s auto-rebalancing keeps risks in check amid $1B and TVL surges.

Transitioning to the Aave V3 USDC Recursive Loop demands vigilance on health factor post-pause. Deposit USDC, borrow against it iteratively to 2.5x, pausing at a 1.2-1.5 safety buffer. Reserved DRIP rewards await, potentially rivaling Morpho’s volume once active. For hybrids, route Morpho-borrowed syrupUSDC to Aave, layering leverages for superior risk-adjusted returns. These strategies, rooted in DRIP’s protocol-agnostic design, position you to outpace the field’s short-term hype with sustainable Arbitrum DeFi yields 2025. See detailed guides at Arbitrum DRIP looping strategies 2025.

Continuing the lineup, the syrupUSDC Max Yield Loop on Morpho flips USDC into syrupUSDC positions through targeted markets, borrowing against the collateral’s native yields to inflate DRIP performance metrics and tap the 90K ARB pool. This loop prioritizes yield compounding over raw leverage, suiting those chasing Arbitrum DeFi yields 2025 without aggressive risk.

- syrupUSDC Max Yield Loop on Morpho: Loop USDC into syrupUSDC positions via Morpho markets, borrowing against native yields to boost DRIP performance-based ARB (90K pool). A yield-first approach for sustained compounding amid Morpho’s $1B TVL milestone.

- Risk-Adjusted 4x Stablecoin Loop: Use Morpho optimizer vaults for USDC/syrupUSDC, cap leverage at 80% utilization with auto-rebalancing to secure yields amid $1B and TVL milestone. Perfect for weathering volatility while stacking earn ARB rewards DRIP.

DRIP Epoch 5: Comparison of 5 Looping Strategies on Morpho/Aave

| Strategy | Max Leverage | Target Rewards (ARB) | Est. APY (incl. syrupUSDC) | Risk Level |

|---|---|---|---|---|

| Morpho syrupUSDC/USDC 3x Loop (Supply syrupUSDC, borrow USDC @75% LTV) |

3x | Share of 420K pool | 18-22% | Medium 🟡 |

| Aave V3 USDC Recursive Loop (Iterative borrow to leverage, post-pause) |

2.5x | Reserved rewards | 12-16% | Low 🟢 |

| Hybrid Morpho-Aave Loop (USDC on Morpho to Aave leverage) |

3.5x | 420K + reserved | 20-25% | High 🔴 |

| Morpho syrupUSDC Max Yield Loop (Loop USDC into syrupUSDC) |

5x | 90K dedicated pool | 22-28% | High 🔴 |

| Risk-Adjusted 4x Stablecoin Loop (Morpho vaults w/ auto-rebalance) |

4x | Share of 420K pool | 16-20% | Low 🟢 |

These five strategies stand out in Epoch 5 because they align precisely with DRIP’s borrow-volume emphasis, where Morpho’s 420K ARB allocation dwarfs others. The Risk-Adjusted 4x Loop, for instance, employs Morpho’s vaults to automate deleveraging at 80% utilization, preserving capital as TVL climbs past $1B. In my view, over-reliance on Aave’s paused markets handicaps aggressive plays, but hybrids bridge the gap effectively once reserves activate.

Implementing the Risk-Adjusted 4x Stablecoin Loop reveals Morpho’s maturity. Vaults handle rebalancing, curtailing liquidation odds in choppy markets. At ARB’s $0.2199 price, a $50,000 deployment might yield $200-400 weekly in rewards atop 12-18% base APYs, per current utilization. This edges out pure Aave recursion, which demands manual health factor tweaks post-pause.

Blending these into portfolios amplifies stablecoin lending Arbitrum efficiency. The syrupUSDC Max Yield Loop, for example, layers native syrup yields (often 8-12%) with DRIP multipliers, outpacing unlevered holds. Yet Epoch 5’s performance phase favors top markets; Morpho’s lead could consolidate if Aave lags. Governance updates signal Fluid and Euler as alternatives, but stablecoin focus keeps Morpho/Aave central.

Risks demand scrutiny. Looping at 3x-4x invites cascades if rates spike or collateral dips; DRIP warnings are blunt, ARB at $0.2199 doesn’t indemnify wipeouts. Maintain 1.2 and health factors, diversify across strategies, and eye utilization dashboards. With Arbitrum’s $19.1B TVL edge over Base, DRIP cements its L2 primacy, but sustainable yields hinge on prudent leverage, not reward chases.

Positioning now, as Epoch 5 unfolds, equips traders for DRIP’s full season. Morpho’s syrupUSDC dominance and Aave’s reserves promise elevated Aave Morpho looping Arbitrum returns, provided discipline prevails. Arbitrum DeFi yields 2025 will reward the prepared, turning incentives into lasting liquidity edges.