In the high-stakes arena of Arbitrum DeFi, GMX GLV liquidity tokens have emerged as a powerhouse for yield generation, especially now that they serve as collateral on Morpho Arbitrum. With GMX trading at $8.71 – up $0.5800 ( and 0.0713%) over the past 24 hours, hitting a high of $8.71 and low of $8.06 – holders can loop liquidity to stack yields exceeding 20% in 2025. This setup combines GMX’s real yield model from trading fees with Morpho’s efficient lending markets, amplified by Arbitrum’s DRIP incentives.

GMX GLV: The Backbone of Arbitrum Perpetual Liquidity

GMX dominates Arbitrum as the leading perpetuals protocol, channeling liquidity through GM Pools and GLV tokens like GLV

Data from Messari underscores the timing: as of December 2,2025, this support enables GLV holders to lend assets directly or collateralize for borrows, layering Morpho APYs atop GMX’s baseline returns. Historical GLV yields have hovered 10-15% from fees alone; layering lending pushes composites toward 20% and, assuming stable market conditions and optimal loan-to-value ratios below 70%.

Arbitrum’s ecosystem mapping positions GMX at the apex, with Ostium trailing as second-largest. Morpho’s MIP-114 incentives further grease the wheels, distributing rewards to cement its role in Arbitrum lending. The result? GLV providers aren’t just passive; they’re active yield machines.

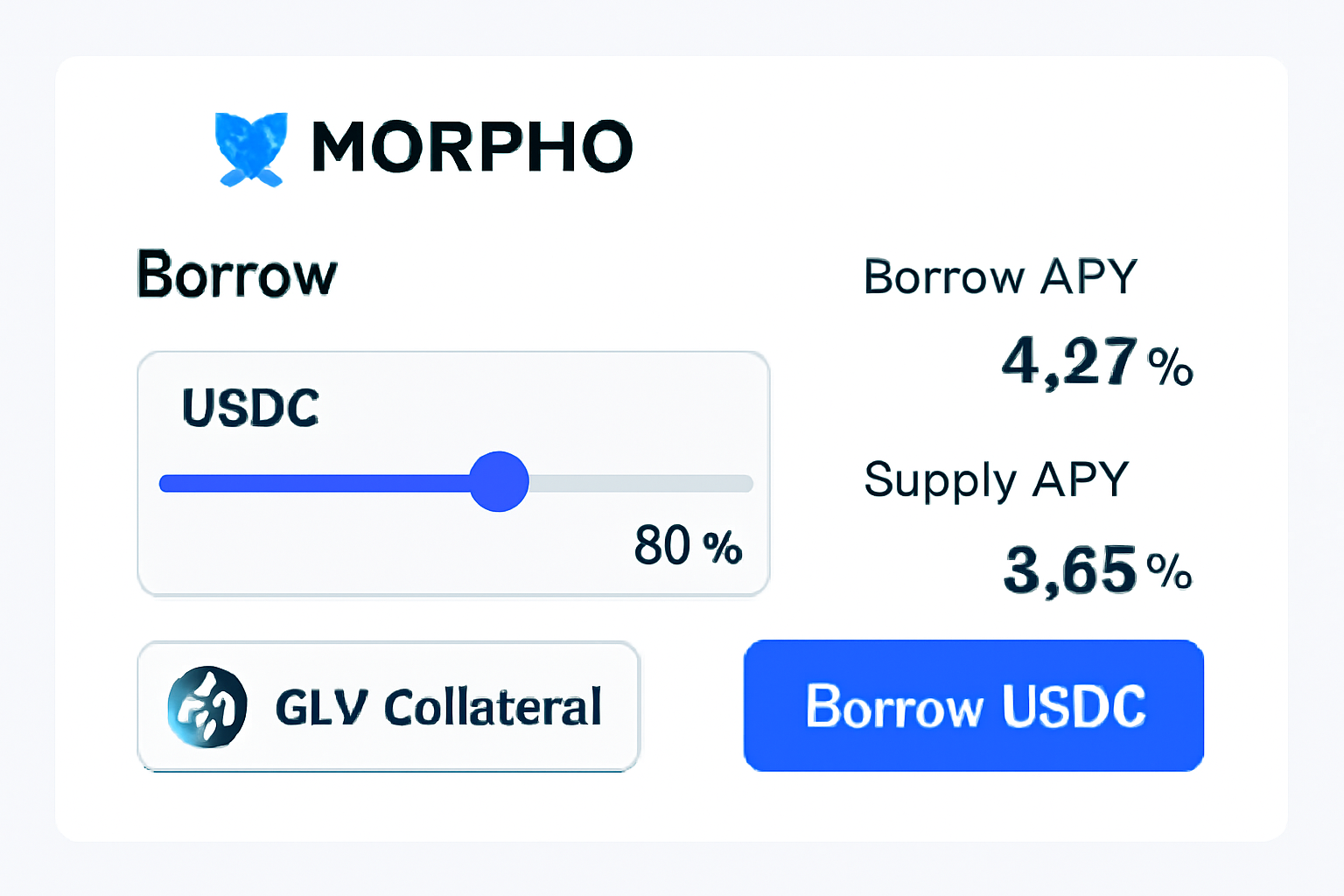

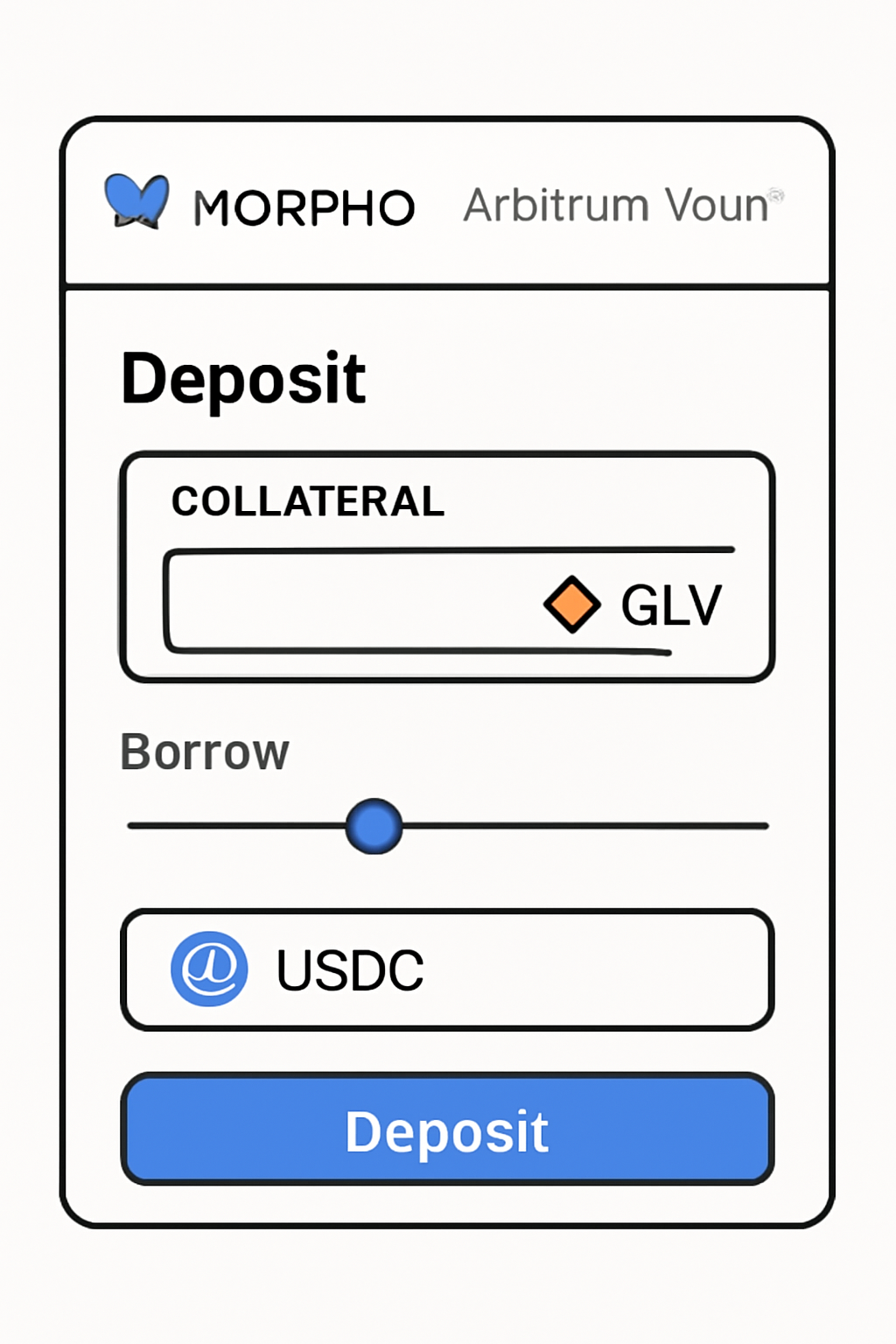

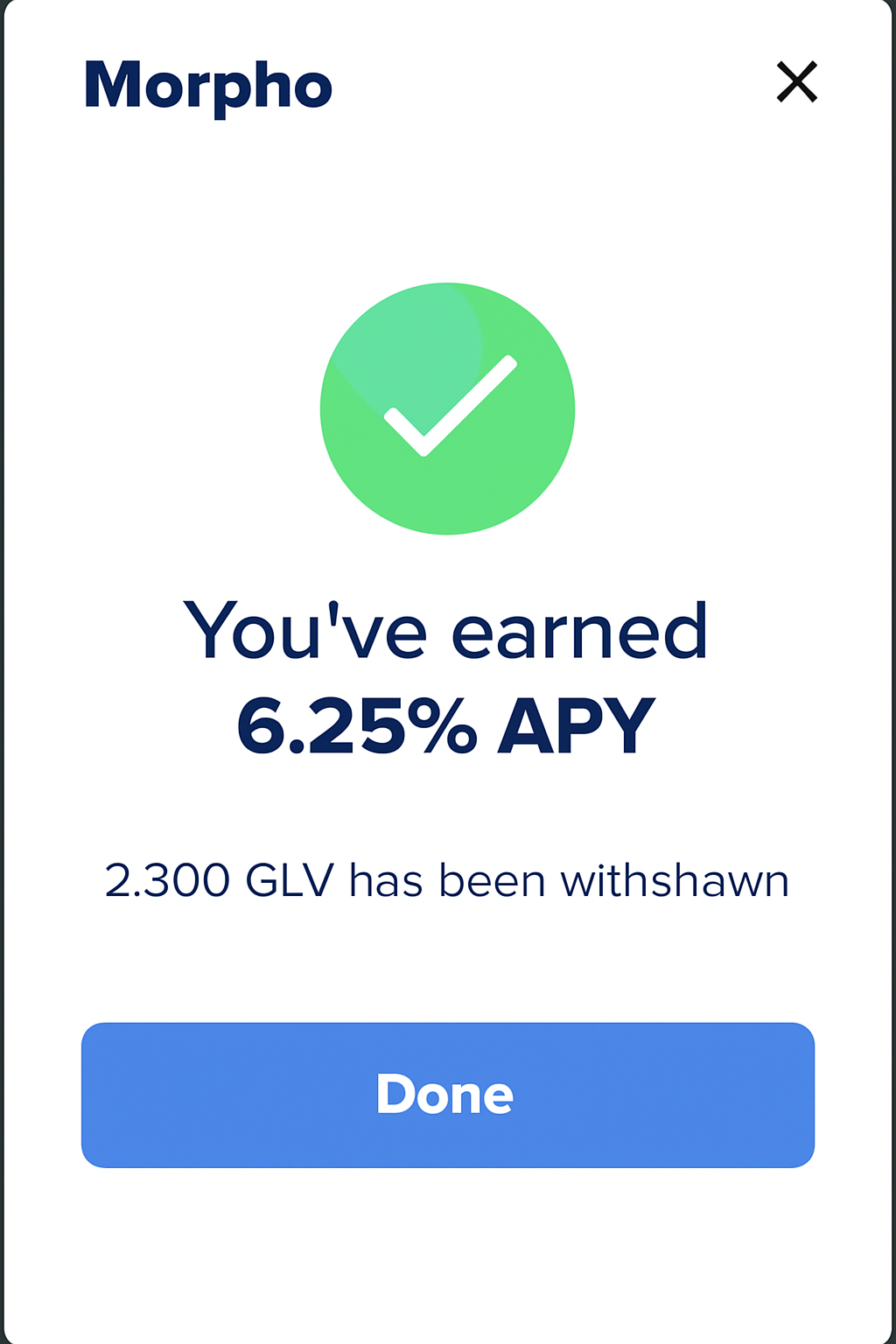

Morpho Arbitrum: Precision Lending for GLV Optimization

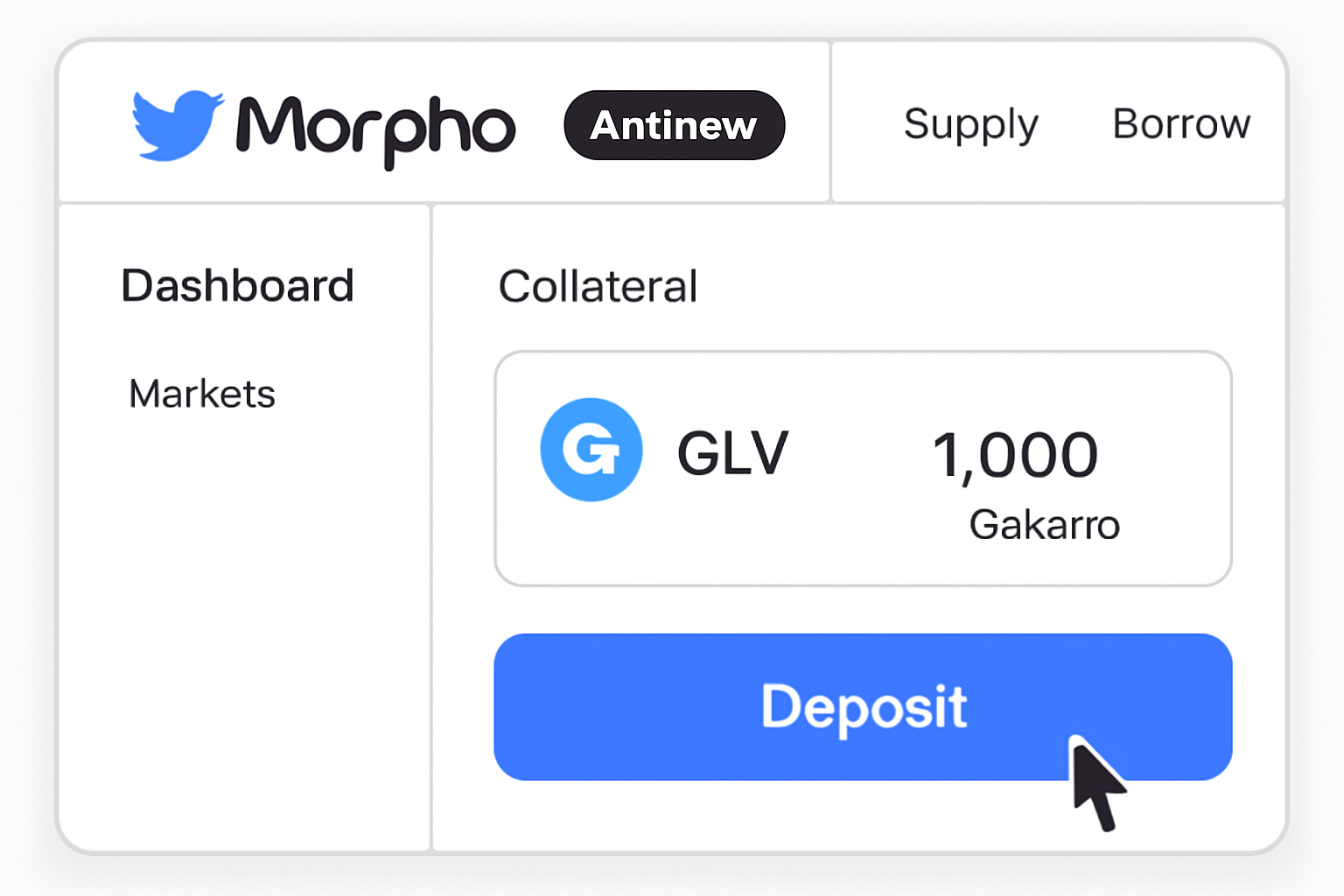

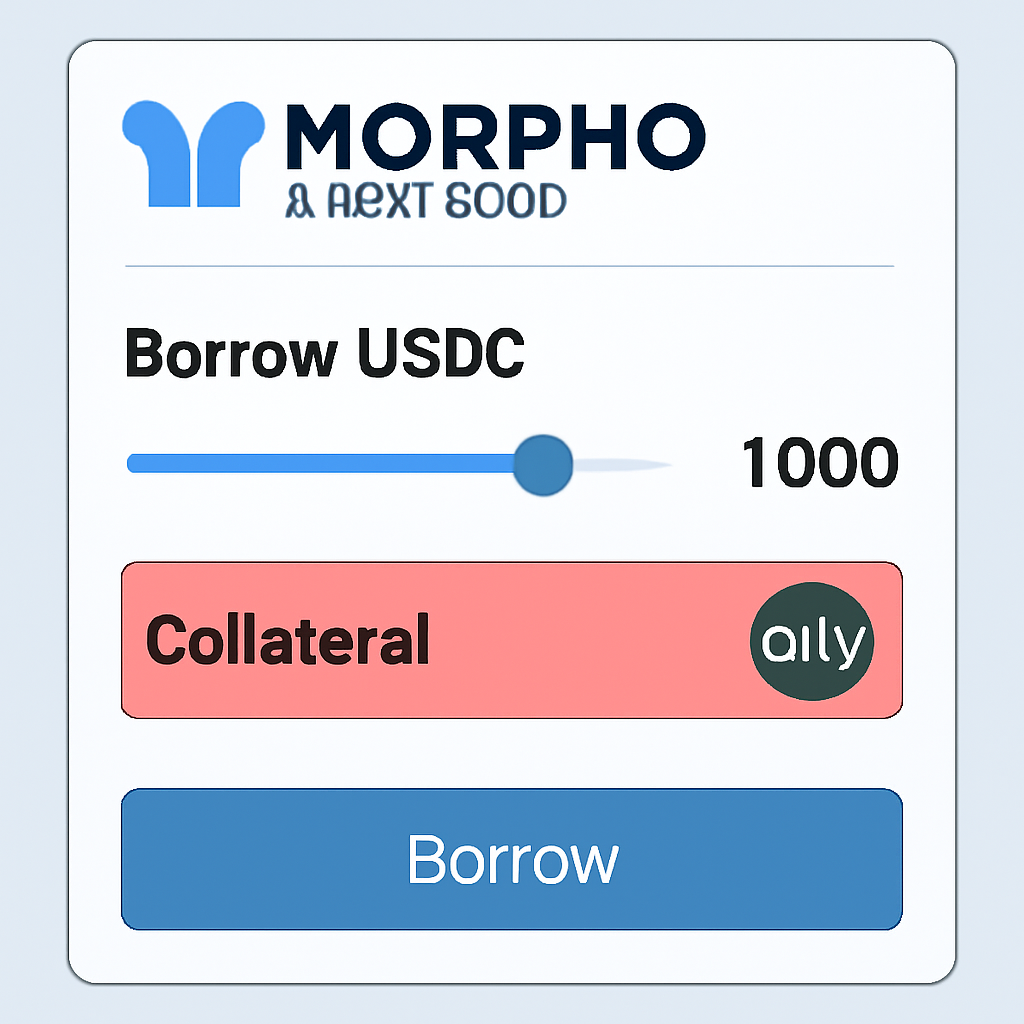

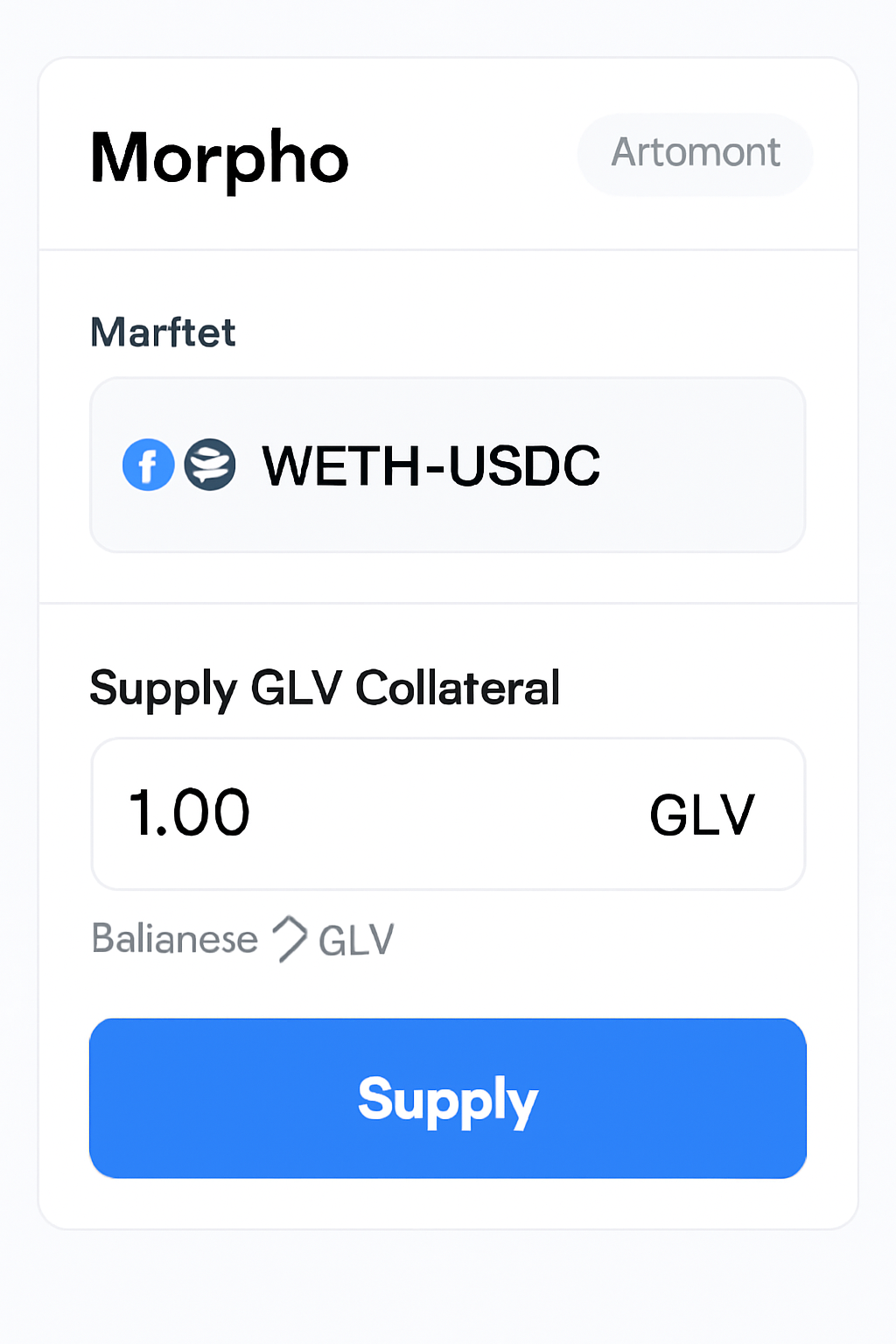

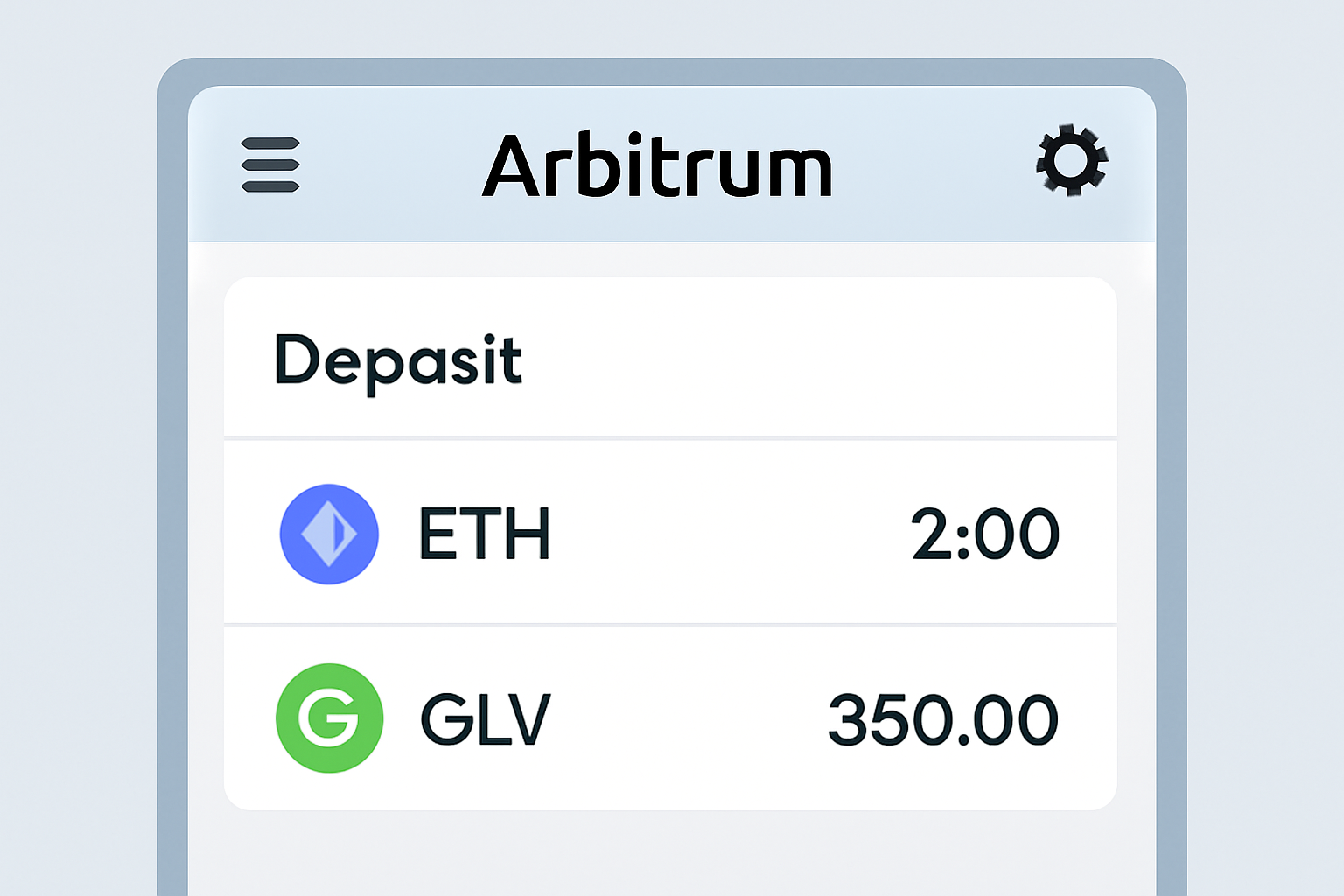

Morpho’s vault-based markets excel in low-slippage borrowing, now tailored for GMX GLV. Holders supply GLV

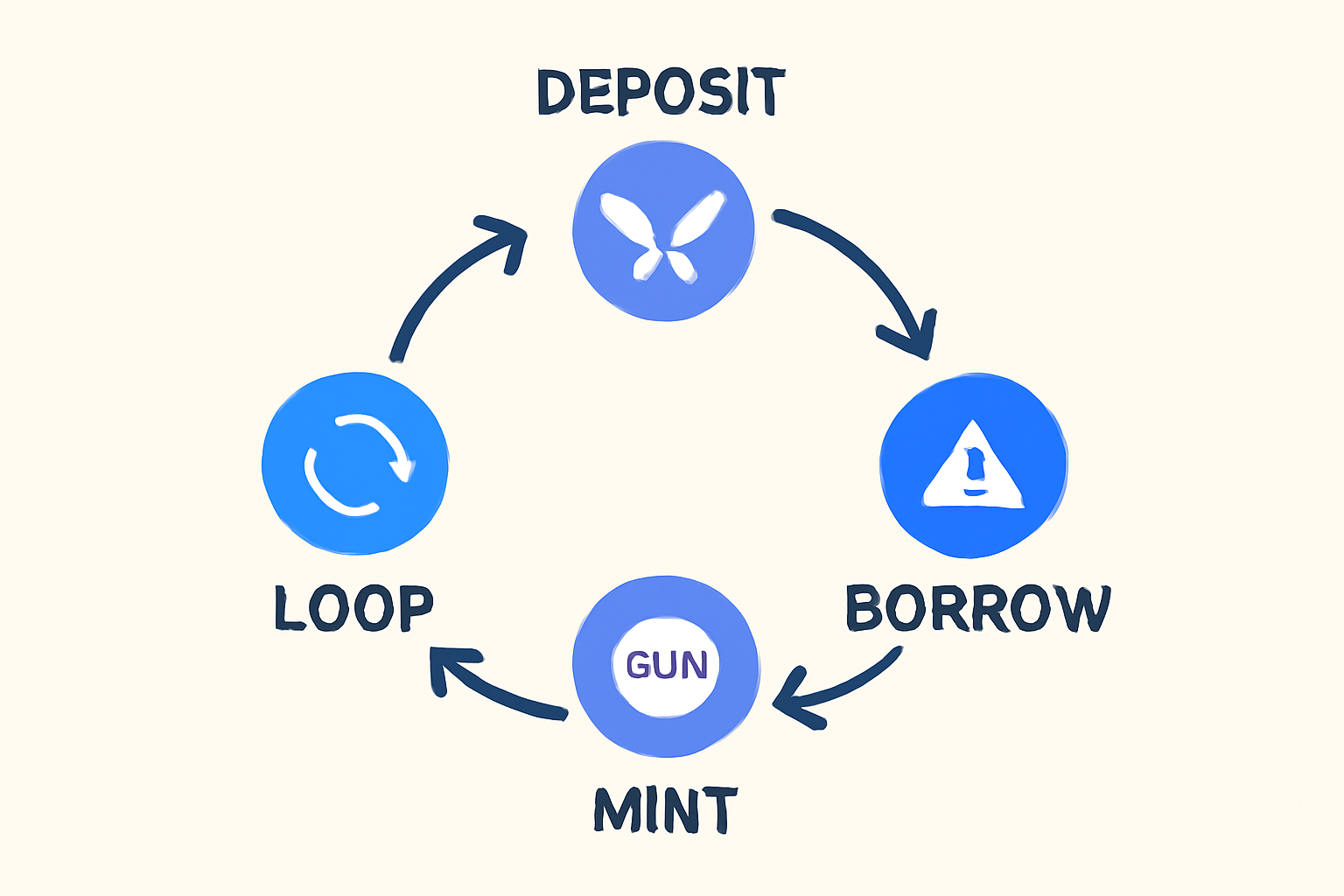

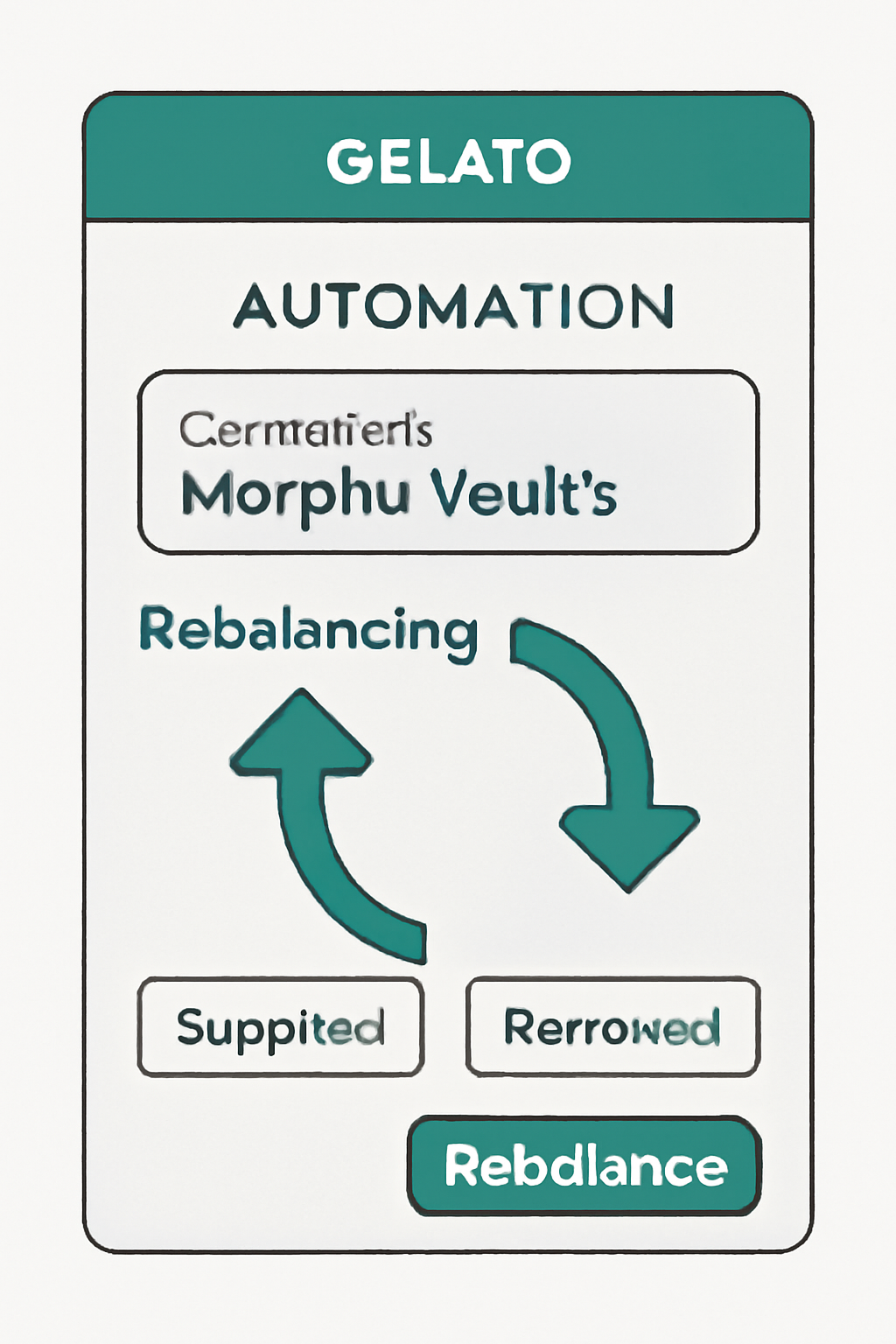

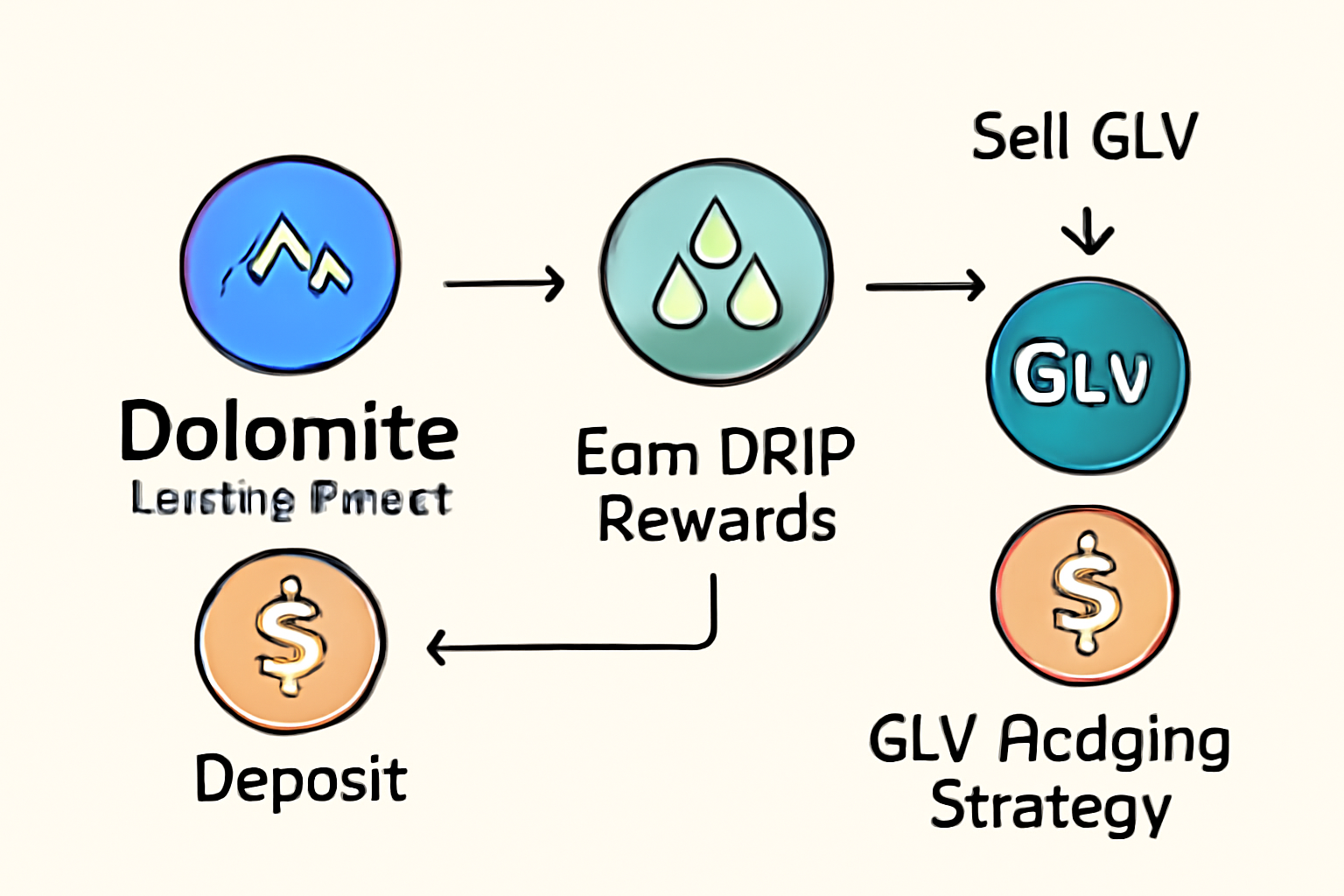

DRIP Incentives: Turbocharging Arbitrum Liquidity Loops

Arbitrum’s DRIP program ignites the flywheel. Season One targets leverage looping on Arbitrum One, rewarding eligible borrows with ARB tokens. GMX users score on Morpho via gmETH positions, but GLV shines brightest: Dolomite’s extension offers delta-neutral strategies, layering DRIP atop GMX yields. Outposts. io reports live incentives for GMX GM tokens and GLV, potentially adding 5-10% ARB rewards annualized.

Positioning matters. Loop GLV on Morpho, qualify for MIP-114 distributions, and capture DRIP multipliers. Markets. com analysis frames this as Arbitrum’s DeFi revival playbook, countering TVL stagnation. For GLV holders eyeing 2025, this triad – GMX fees, Morpho lending, DRIP airdrops – forges paths to 25% and net yields, calibrated against GMX’s steady $8.71 price anchor.

The chart tells the story – listen closely: GLV loops aren’t a fad; they’re the next efficiency frontier.

Yield projections hinge on execution. A $10,000 GLV deposit at current rates – GMX fees at 12-15% annualized, Morpho supply APY around 4-6%, borrow rates under 5% – nets 18-22% after fees in a single loop. Triple the cycle, and backtests from Morpho docs suggest 25% and composites, assuming GMX holds $8.71 and volatility stays moderate. DRIP adds the kicker: ARB rewards scale with borrow volume, pushing effective APYs past 20% for disciplined loopers.

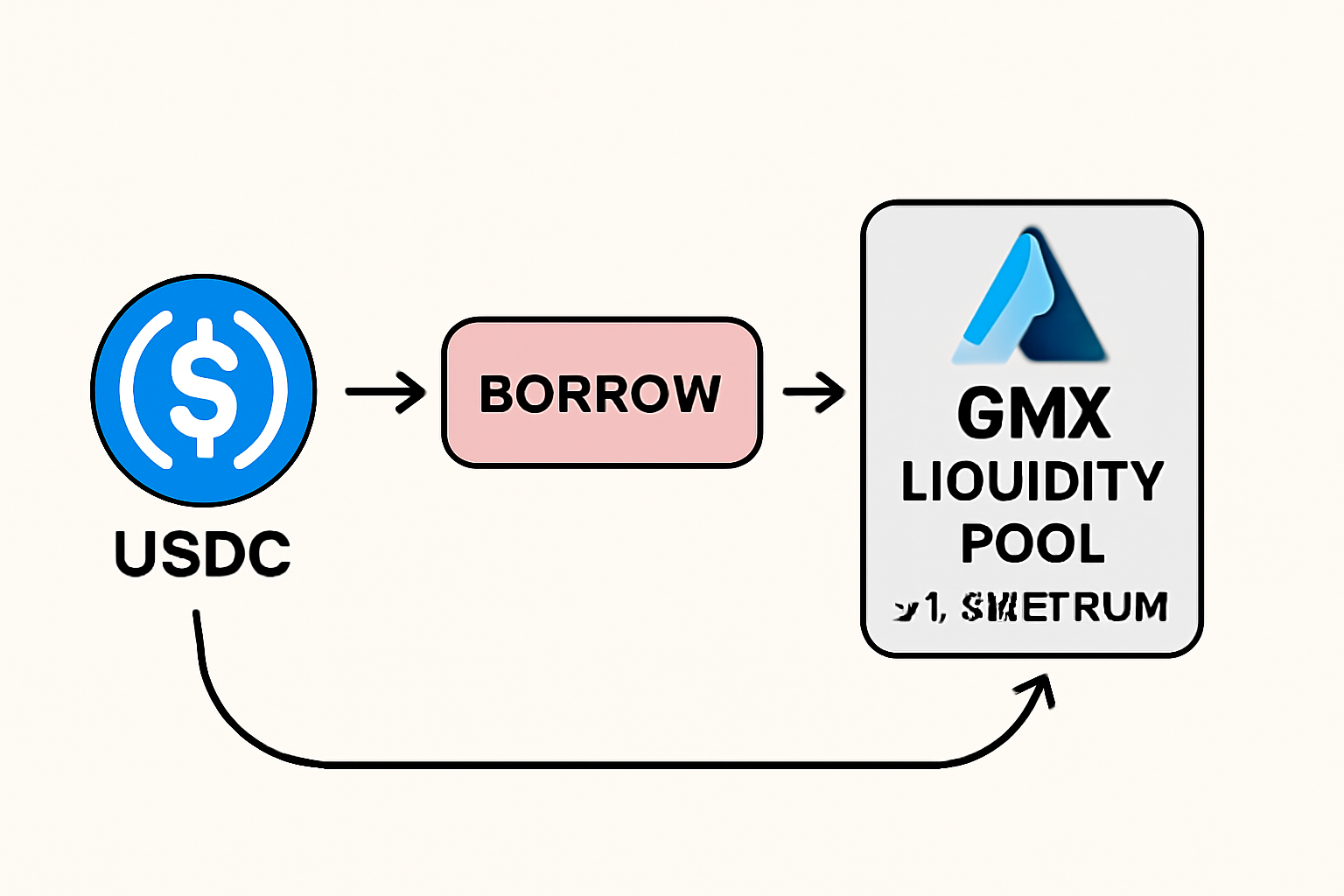

Arbitrum Liquidity Looping: Step-by-Step GMX Vaults Borrowing Guide

Precision defines winners here. GLV looping on Morpho Arbitrum demands tight risk controls, but the mechanics reward repetition. Start with GLV

This isn’t guesswork. MIP-114 allocates incentives precisely to high-volume markets like GLV-USDC, while Dolomite’s DRIP layer opens delta-neutral plays – short perps against GLV longs for pure yield capture. GMX’s real yield model shines: no token inflation, just fees from $8.71 GMX-anchored trades.

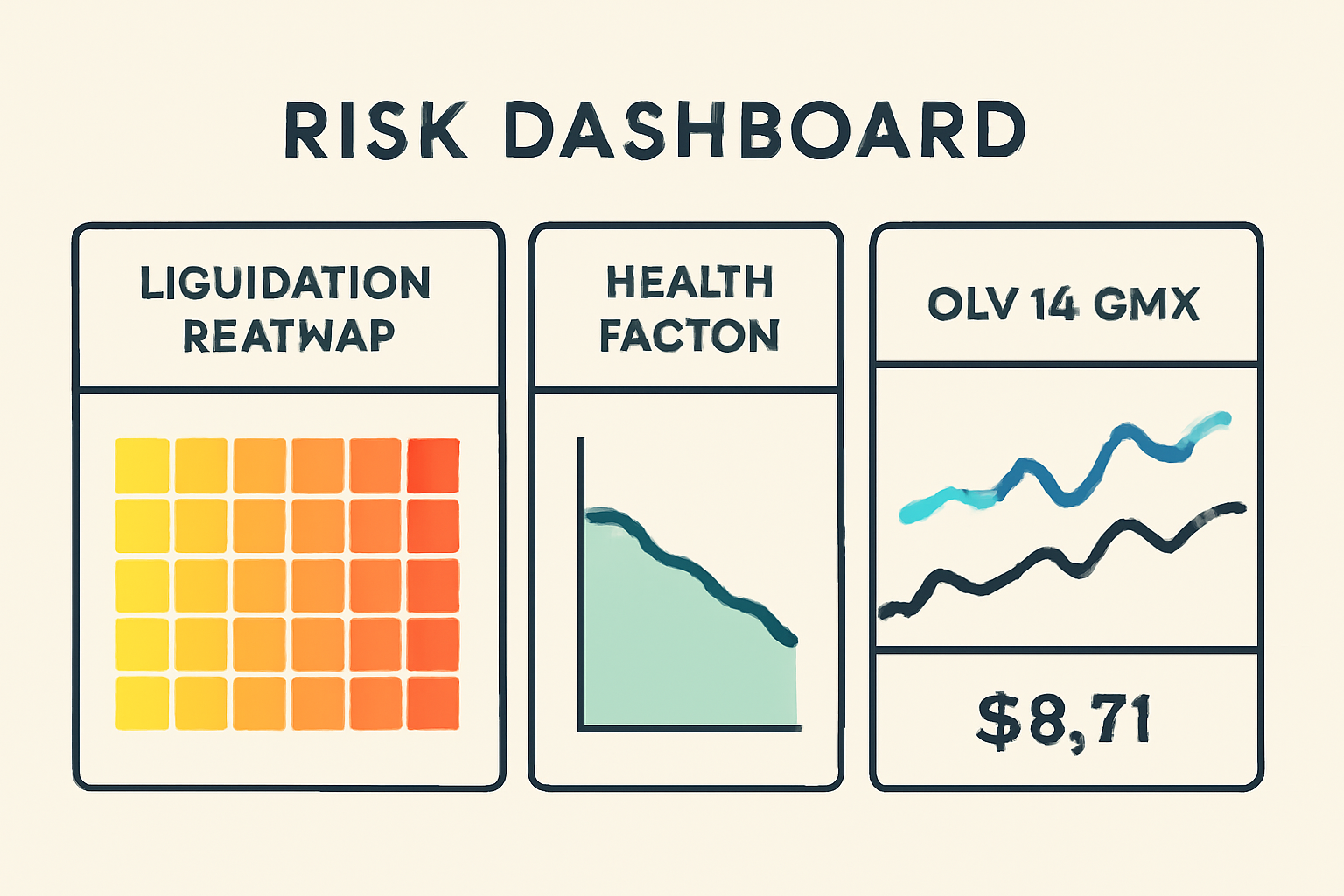

Risk Calibration: Guarding Against Liquidation in Volatile Markets

High yields carry edges. GLV collateral faces oracle risks and perp funding swings; Morpho enforces 80% max LTV, but flash crashes demand buffers. At $8.71 GMX, GLV

Arbitrum’s DeFi revival gains traction through these vectors. DRIP Season One funnels ARB to loopers, with GMX users front-running via gmETH and GLV. Outposts. io flags Dolomite as the sleeper hit, where GM tokens enable advanced strategies yielding 5-10% extra annualized. Stack MIP-114 points, and 2025 composites could hit 28% for top quartiles.

2025 Outlook: Scaling to 25% and with DRIP LP Optimization

Forward scan: GMX at $8.71 signals maturity, with TVL rebounding 30% post-DRIP. Morpho vaults will deepen, dropping borrow rates sub-4%; GLV supply could double if incentives hold. Loopers optimizing Arbitrum DRIP LP positions – via gm pools first, then Morpho recursion – position for asymmetric returns. Messari pegs ecosystem growth at 50% YoY, fueled by real yield protocols like GMX.

Discipline compounds. Start small, loop methodically, harvest DRIP. GLV on Morpho isn’t just collateral; it’s a leverage flywheel for Arbitrum dominance. Track the charts – they whisper the path to 20% and yields.