With Ethereum trading at $2,824.05 amid a choppy market, Arbitrum’s DeFi Renaissance Incentive Program (DRIP) Epoch 6 presents a golden window for savvy traders to stack serious rewards through ETH leverage looping on protocols like Aave, Morpho, and Silo. This $40 million initiative, now in its performance phase, doles out ARB tokens to boost capital-efficient strategies, and with ETH derivatives like weETH and stablecoins in play, yields are spiking. I’ve crunched the latest forum updates and TVL data; it’s time to dive into battle-tested setups that could net you 12-18% blended APYs plus juicy incentives.

DRIP Epoch 6 ramps up the focus on productive borrowing against yield-bearing ETH assets, rewarding protocols that deliver real traction. Aave returns with 1.2 million ARB, while Morpho, Silo, and Euler split millions more until late November. But here’s the kicker: looping amplifies your exposure, turning a simple deposit into leveraged firepower. Just remember, as Arbitrum’s governance warns, these plays carry liquidation risks; ARB rewards won’t cover total losses if ETH dips hard below key levels.

Unlocking Epoch 6’s Hottest Incentives

Season One of DRIP, kicking off back in September 2025, zeroed in on leveraged looping to supercharge Arbitrum DeFi TVL. Epochs run bi-weekly, with allocations shifting to top performers. Post-epochs 3-5, where Aave paused, Epoch 6 redistributes heftily: think 2 million ARB across Euler, Morpho, Fluid, Silo, and Dolomite. For ETH loopers, this means targeting supported collaterals like wstETH or rsETH on active markets. Check Arbitrum’s DRIP deep dive for the full mechanics, but the strategy is simple: supply, borrow, loop, earn.

Participating protocols include Aave, Morpho, Fluid, Euler, Dolomite, and Silo, with rewards distributed across two-week epochs.

Current vibes from X show hype building, with Silo’s USDC vaults at 10.11% APR and $5.67M TVL. Pair that with ETH at $2,824.05, and looping makes sense if you monitor health factors religiously.

Top ETH Leverage Looping Strategies Tailored for Epoch 6

To crush Arbitrum DRIP Epoch 6, stick to these proven ETH leverage looping strategies optimized for Aave, Morpho, Silo, and Euler. They balance high yields with manageable risks, leveraging the program’s ARB multipliers on ETH-USDC borrows and derivatives. I’ve prioritized setups with real TVL backing and projected returns factoring in base APY plus incentives.

Ethereum (ETH) Price Prediction 2026-2031

Long-term forecast considering Arbitrum DRIP Epoch 6 looping strategies volatility, DeFi growth on L2s, and broader market trends amid current price of $2,824.05

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior) |

|---|---|---|---|---|

| 2026 | $2,800 | $3,900 | $5,600 | +38% |

| 2027 | $3,500 | $5,200 | $7,500 | +33% |

| 2028 | $4,500 | $6,800 | $10,000 | +31% |

| 2029 | $5,800 | $9,000 | $13,500 | +32% |

| 2030 | $7,200 | $11,500 | $17,500 | +28% |

| 2031 | $9,000 | $14,500 | $22,000 | +26% |

Price Prediction Summary

Ethereum is forecasted to see robust long-term growth, with average prices climbing from $3,900 in 2026 to $14,500 by 2031 (over 5x from current $2,824). Short-term volatility from DRIP Epoch 6 leveraged looping on Arbitrum may introduce swings in the next 7-30 days, but sustained DeFi TVL increases, L2 adoption, and ETH ecosystem upgrades support bullish trajectories. Min/max ranges account for bearish corrections (e.g., regulatory hurdles) and bullish surges (e.g., mass adoption).

Key Factors Affecting Ethereum Price

- Arbitrum DRIP $40M incentives driving leveraged ETH looping on Aave, Morpho, Silo boosting L2 TVL and ETH demand

- Ethereum L2 scaling (e.g., Arbitrum growth) reducing fees and enhancing usability

- Regulatory developments and potential ETF expansions increasing institutional inflows

- Network upgrades like future Danksharding for scalability and security

- Crypto market cycles influenced by Bitcoin halvings and macroeconomics

- Risks from DeFi liquidations in looping strategies and competition from Solana/Base

- Rising ETH staking yields and restaking derivatives supporting price floors

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

- Aave V3 ETH-USDC 3x Looping: Deposit ETH, borrow USDC, swap to ETH, repeat for max DRIP rewards (APY ~12% and incentives). Aave’s return juices this; loop thrice for 3x leverage while keeping LTV under 80%.

- Morpho Blue ETH Vault 4x Leverage Loop: Use Morpho vaults for optimized borrowing rates, targeting 15% and blended yield with Epoch 6 ARB multipliers. Morpho’s peer-to-peer matching slashes costs here.

- Silo Finance Isolated ETH 2.5x Loop: Leverage ETH collateral in isolated markets for low liquidation risk and high Silo points (TVL $150M and risk-adjusted). Perfect for conservative maxis.

- Euler E-Mode ETH Looping 3.5x: Cross-correlated ETH assets for efficient capital, capturing Euler’s DRIP share with real-time 18% projected returns. E-Mode crushes correlated borrows.

Mastering Aave V3 ETH-USDC 3x Looping Step-by-Step

Let’s break down the Aave V3 ETH-USDC 3x loop, a staple for ETH leverage looping on Arbitrum. Start by bridging ETH worth $10,000 at $2,824.05 per ETH (about 3.54 ETH) to Arbitrum via official bridges. Head to Aave V3: supply your ETH as collateral, earning native yield. Borrow USDC up to 75% LTV, swap on Uniswap or Perpetual Protocol to more ETH, and redeposit. Rinse twice more for 3x leverage. At current rates, expect ~4% supply APY, 6% borrow costs, netting 12% plus DRIP’s ARB boost. Monitor ETH price; a drop to $2,500 could stress health factors, so set alerts at 82% utilization.

Pro tip: Use Aave’s risk dashboard and pair with this looping guide for automation scripts. Yields hit hardest when TVL surges, aligning perfectly with Epoch 6’s Aave revival.

Next up in the Morpho deep dive, but first, gauge your risk tolerance; these aren’t set-it-and-forget-it plays in volatile times.

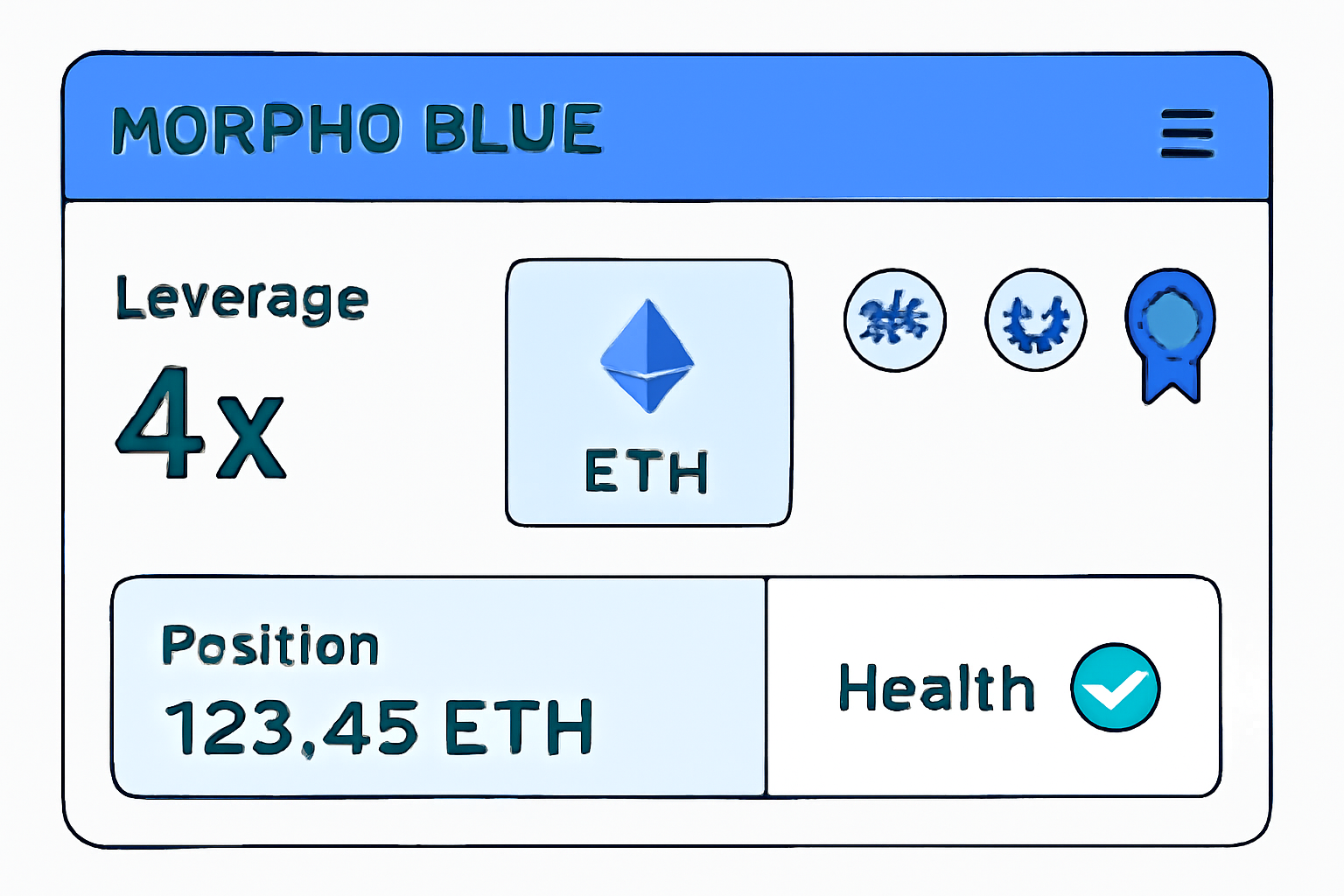

With Morpho’s peer-to-peer magic, you can push leverage higher without the borrow rate spikes that plague traditional pools. This setup shines in Epoch 6, where Morpho Labs snags a fat slice of ARB rewards for ETH vault activity. I’ve seen traders loop 4x here and walk away with blended yields north of 15%, blending base lending rates with DRIP multipliers. But it demands precision; Morpho’s vaults optimize for specific collaterals like weETH, so align your assets accordingly.

Morpho Blue ETH Vault 4x Leverage Loop: Precision Power Play

Bridge your ETH to Arbitrum, then hit Morpho Blue’s ETH vault. Supply ETH or wstETH, borrow USDC at sub-5% rates thanks to P2P matching, swap to more ETH via integrated DEXs, and redeposit up to four cycles. At ETH’s $2,824.05 price, a $10,000 position (3.54 ETH) balloons to effective 4x exposure. Supply APY hovers at 5-7%, borrow costs stay lean at 4.5%, netting 15% and before ARB kicks in. Health factor? Keep it above 1.5; Morpho’s dashboards make this a breeze. Epoch 6’s focus on productive borrows supercharges this, especially with TVL climbing fast.

Silo Finance flips the script with isolated markets, shielding your ETH from broader pool volatility. At $150M and TVL, it’s a risk-adjusted gem for DRIP Epoch 6, piling on Silo points alongside ARB. Conservative yet potent, this 2.5x loop suits those eyeing steady 10-12% yields without sleepless nights.

Silo Finance Isolated ETH 2.5x Loop: Safe Haven Leverage

Dive into Silo’s Optima Vault or ETH isolated pool: deposit ETH, borrow USDC conservatively (60% LTV max per cycle), swap, repeat 2.5 times. With ETH at $2,824.05, your stack grows efficiently while isolation caps liquidation cascades. Current USDC lending hits 10.11% APR; loop it for 12% net, plus Silo’s points and DRIP ARB. Liquidation buffer is generous here, ideal if ETH volatility persists post its -6.70% 24h dip. Pair with arbitrumdrip. com for live rewards tracking.

Euler rounds out the quartet with E-Mode, turbocharging correlated ETH assets like rsETH and weETH. This 3.5x loop captures Euler’s 2M ARB pool in Epoch 6, projecting 18% returns in real-time dashboards. It’s capital-efficient wizardry for aggressive players.

Euler E-Mode ETH Looping 3.5x: Correlated Capital Crusher

Activate E-Mode on Euler for ETH derivatives, supply your base, borrow against siblings at slashed rates (under 4%), loop 3.5x via quick swaps. A $10,000 ETH position at $2,824.05 leverages into serious firepower, with 6-8% supply yields offsetting costs for 18% blended. E-Mode’s correlation logic minimizes overcollateralization waste, but watch for ETH’s 24h low of $2,805.86; alerts at $2,700 keep you golden.

DRIP Epoch 6 ETH Looping Strategies Comparison

| Strategy | Leverage | Projected APY | Risk Level | Est. TVL | Liquidation Buffer |

|---|---|---|---|---|---|

| Aave V3 ETH-USDC 3x Looping: Deposit ETH, borrow USDC, swap to ETH, repeat for max DRIP rewards (APY ~12% + incentives) | 3x | ~12% | Medium 🟡 | High (>$500M) | 12-15% |

| Morpho Blue ETH Vault 4x Leverage Loop: Use Morpho vaults for optimized borrowing rates, targeting 15%+ blended yield with Epoch 6 ARB multipliers | 4x | 15%+ | Low-Medium 🟢🟡 | $200M+ | 10-13% |

| Silo Finance Isolated ETH 2.5x Loop: Leverage ETH collateral in isolated markets for low liquidation risk and high Silo points (TVL $150M+ risk-adjusted) | 2.5x | 12% | Low 🟢 | $150M+ | 18-22% |

| Euler E-Mode ETH Looping 3.5x: Cross-correlated ETH assets for efficient capital, capturing Euler’s DRIP share with real-time 18% projected returns | 3.5x | 18% | Medium-High 🟡🔴 | $30M+ | 9-12% |

These ETH leverage looping Arbitrum plays on Aave, Morpho, Silo, and Euler aren’t just theoretical; they’re crushing it amid DRIP’s $40M push. Aave V3 offers familiarity, Morpho efficiency, Silo safety, Euler edge. Stack them rotationally based on weekly allocations, but always prioritize health factors. With ETH at $2,824.05 and incentives peaking, now’s prime time to engage. Dive deeper via Epoch 6 specifics, track TVL surges, and loop smart. Understand the mechanics, execute boldly, and watch those ARB rewards compound your edge in Arbitrum DeFi.